Unity Software’s (NYSE:U) quick per cent of float has risen 25.67% because its previous report. The business not long ago described that it has 13.59 million shares bought small, which is 7.49% of all regular shares that are available for buying and selling. Based on its buying and selling quantity, it would choose traders 3.4 days to include their quick positions on common.

Why Short Desire Issues

Short interest is the amount of shares that have been sold short but have not yet been protected or closed out. Short selling is when a trader sells shares of a business they do not possess, with the hope that the cost will drop. Traders make income from limited providing if the value of the stock falls and they lose if it rises.

Short fascination is vital to keep track of due to the fact it can act as an indicator of marketplace sentiment in direction of a certain stock. An raise in brief curiosity can signal that buyers have grow to be much more bearish, although a lessen in quick fascination can sign they have grow to be extra bullish.

See Also: Checklist of the most shorted shares

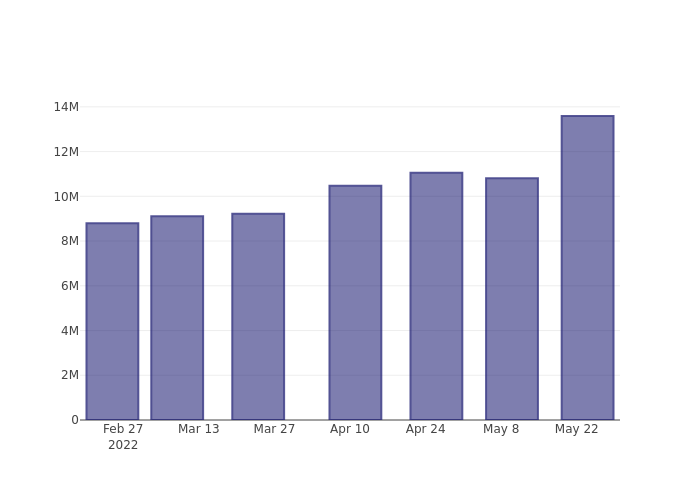

Unity Program Brief Desire Graph (3 Months)

As you can see from the chart earlier mentioned the share of shares that are sold shorter for Unity Computer software has developed given that its past report. This does not mean that the inventory is likely to fall in the close to-expression but traders must be conscious that far more shares are currently being shorted.

Comparing Unity Software’s Limited Desire In opposition to Its Peers

Peer comparison is a popular method amongst analysts and investors for gauging how nicely a organization is undertaking. A firm’s peer is one more enterprise that has comparable attributes to it, these as field, sizing, age, and money structure. You can come across a company’s peer team by examining its 10-K, proxy submitting, or by doing your individual similarity assessment.

According to Benzinga Professional, Unity Software’s peer group typical for quick curiosity as a percentage of float is 2.45%, which means the corporation has much more quick curiosity than most of its peers.

Did you know that expanding brief curiosity can really be bullish for a stock? This write-up by Benzinga Cash describes how you can earnings from it..

This report was generated by Benzinga’s automatic content engine and was reviewed by an editor.